The premise of investment is not to lose money; losing money will ultimately make your returns look very ugly. In order to achieve long-term stable returns, what should you do?

How should ordinary people construct their own investment portfolios and allocate their funds reasonably?

I. What to Buy?

There are many types of assets. From the perspective of safety and liquidity, we can categorize assets into three types:

First category: Safe and liquid assets, representative assets (deposits, money market funds, government bonds);

Second category: Unsafe but liquid assets, representative assets (stocks, funds, corporate bonds, options, futures);

Third category: Unsafe and illiquid assets, representative assets (real estate, antiques, calligraphy and paintings, diamonds);

1. Do not touch what you do not understand.For instance, take the previously popular P2P lending and blockchain digital currencies. Many people don't understand them but, seeing others around them make money, they can't resist the temptation and follow the trend by investing. The result? Many end up losing their entire investment.

Advertisement

Consider calligraphy, antiques, and diamonds. Many people also don't understand these markets, but they perceive them as high-class and want to invest a little. This is very risky. If you don't understand, but others do, you can easily become the "leeks" (a term used to describe inexperienced investors who are easily exploited), and be harvested by those who know more than you.

2. Distinguish between safe and risky assets

Deposits, money market funds, and government bonds are considered safe assets. They are backed by a promise of full repayment, have the backing of the state, and have excellent liquidity. Moreover, deposits and money market funds, such as Yu'e Bao, are generally accessible at any time.

Stocks, corporate bonds, funds, and real estate are considered risky assets. Typically, when you need money, you can sell stocks and get the cash the next day, sell funds and get the money in about three to four days, but real estate has poor liquidity. Generally, when a house is listed for sale, it can take from a few months to over a year to sell. Investing in real estate should be based on long-term value, not on the ability to liquidate at any time.

II. How much to buy?

Let's say you have 100,000, and your friend has 1,000,000. If you both allocate 50,000 to a certain stock, you have 50% of your capital invested in individual stocks, which is a heavy position, while your friend has only 5% of their capital invested in individual stocks, which is a light position.

If this stock falls, you will suffer a significant loss, while your friend's loss will be minimal. This is the first point about controlling the proportion of assets. Even if one asset loses money, it can be quickly compensated from other aspects.

What if the stock rises?Firstly, we indeed do not know what will rise and what will fall. We assume that the probabilities of rising and falling are both 50%. If you put all your capital at risk, there is a 50% chance of a rise and a 50% chance of a fall. If it rises in the first year and falls in the second year, then after 2 years your capital will essentially remain unchanged.

However, if you construct a prudent portfolio to avoid unnecessary risks, with an annual increase of 6%, after 2 years it will have increased by 12%. In the long term, this investment strategy is steadily rising. Therefore, betting big on individual assets can easily lead to large fluctuations in returns, and the long-term return rate is not actually high.

There are three goals in constructing an investment portfolio:

The first goal is to maintain liquidity. Keep 10% of your capital in liquid form for daily expenses. This prevents excessive cash flow tension and unnecessary sales when losses occur.

The second goal is to diversify risks as much as possible. If you are optimistic about technology stocks, but individual stocks are prone to black swan events, it is better to buy a basket of technology stocks, such as a technology ETF. Even if one stock encounters a black swan event, the gains from other stocks will offset the losses from that stock, allowing you to achieve the average market return without taking on significant risk.

The third goal is to optimize your returns. Generally speaking, the return on safe assets is only 2%-3%. By studying diligently and operating cautiously, allocating assets to those with relatively higher returns (stocks, real estate, funds) can achieve an annual increase of 6%-8%. It is already very good to strive for 10%, which allows you to befriend time and gradually become wealthy.

III. When to buy?

When to buy sounds simple, but it is one of the most difficult decisions in investing and has a significant impact on investment performance.

"Buy low and sell high" is something most people have heard, but who can really buy at the bottom and sell at the top?Here is the translation of the provided text into English:

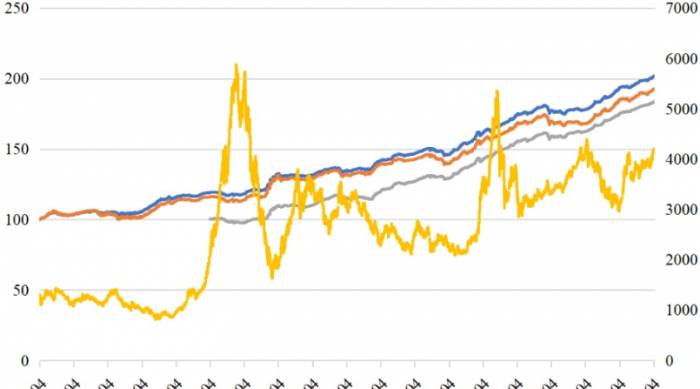

There is a question of investment timing, and there is a fundamental theory called the "Merrill Lynch Clock," which was proposed by Merrill Lynch in 2004. It is a basic theory about investment timing.

This theory divides assets into four categories: bonds, stocks, commodities, and cash. The corresponding economic phases are recession, recovery, overheating, and stagflation.

Bonds perform best during the recession phase, stocks during the recovery phase, commodities during the overheating phase, and cash assets during the stagflation phase.

During the economic recession phase, economic policies are likely to stimulate the economy and increase money supply. However, people with money in hand are hesitant to invest recklessly. Money can't just sit idle; what should be done? The answer is to buy safe assets, like government bonds.

After the economy has been stimulated for a while and has almost bottomed out, business conditions begin to improve. At this time, inflation has not yet picked up. Companies' products become easier to sell, but costs have not started to rise, leading to increased corporate profits. Therefore, it is best to buy stocks at this time.

Inflation begins to rise, and prices start to go up. The fastest price increases are seen in commodities, such as oil, iron ore, and raw materials. This is because companies need to expand their production capacity and capture the market at this time, inevitably increasing the competition for inputs. With a limited production capacity, prices begin to rise, and the price increases for commodities are significant.

Once inflation picks up, the government starts macroeconomic regulation, stocks begin to correct, bond prices fall, and commodities also face the risk of declining. At this point, it is best to do nothing and hold cash, waiting for opportunities.This may sound simple, but it requires certain professional knowledge and a comprehensive understanding of macroeconomics and economic policies.

Investing is a very specialized endeavor, necessitating our continuous learning and assimilation of the latest economic knowledge, as well as an understanding of China's economic cycles. Only by doing so can we potentially make money in the investment market and maximize our own benefits.